Are you thinking of getting into a direct sales business?

Yes, you are thinking right. Direct sales is a successful business for people interested in selling various items directly to consumers.

In 2024, Indeed.com released that around $70,000 is earned by a direct sales representative with a high commission of $23,000.

Image Source: Indeed.com

Now, this looks interesting.

So, if you want to increase your income and dream of a good lifestyle, stop thinking and learn about direct sales companies.

Worry not,

The list of top direct sales companies has been compiled with all the essential details.

Top 15 Best Direct Sales Companies

Various direct sales companies in the world help you to sell your products or services. These direct selling companies offer a business opportunity for you to work from home.

The list of such sales companies that offer sales jobs:

1. Amway

Amway, a giant in the direct selling business, leads globally as a distributor with a diverse product range in nutrition, beauty, and home care. Its unique model supports individuals in starting their own businesses, promising a blend of healthy living and entrepreneurial opportunities.

Who is the Company For

The company that offers health and wellness products is perfect for those aiming to steer their careers in the direct selling industry. It assists people desiring to lead in the selling market, offering a supportive platform for entrepreneurs to grow and thrive while promoting wellness and self-reliance.

What Products Company offer

The platform’s vast product line features nutrition supplements, beauty items, and home decor essentials. They sell their products that are known for their quality, are exclusively sold through direct selling associations, and focus on enhancing health and lifestyle.

Here’s How To Get Started

After learning direct selling facts, sign up to become an Independent Business Owner (IBO), gain access to training and support, and begin selling Amway’s high-quality products. It’s a journey towards entrepreneurship with a proven path and community backing.

2. Mary Kay

Mary Kay specializes in beauty and skincare products. It empowers individuals to become Independent Beauty Consultants, offering a range of cosmetics and personal care items.

Who is the Company For

This company suits anyone aiming to start a business in the beauty industry after knowing the figures and news regarding popular direct sales. It’s perfect for those passionate about skincare and makeup, offering an opportunity to earn by sharing and selling products they love.

What Products Company offer

It offers various Mary Kay products, including a skincare line, makeup, fragrances, and more. Consultants get the chance to sell these high-quality items, helping customers find their perfect beauty solutions, and also earn a commission on monthly sales.

Here is How to Get Started

To begin this business for home bv, find an Independent Beauty Consultant or visit their website to sign up. You’ll receive guidance, training, sell products, and support to start your own business with new direct sales and build your clientele.

3. Tupperware

Tupperware offers convenient kitchen solutions and is known for its durable and innovative products. From containers to cookware, they make daily kitchen tasks easier. Many direct sales companies offer an eco-friendly range designed for sustainable living.

Who is the Company For

This company is perfect for anyone looking to organize their kitchen or find practical, long-lasting storage solutions. It is ideal for home cooks, busy families, and environmental advocates, and the products you sell cater to all who cherish efficiency and sustainability in their daily lives.

What Products Company offer

Tupperware’s lineup includes versatile tools for the kitchen, cookware, bakeware, and reliable food storage options. The company places a strong emphasis on serveware and portable items for on-the-go convenience. For the little ones, there’s a range of kids’ toys and accessories to explore.

Here is How to Get Started

Visit their website to browse the latest in kitchen innovations and eco-friendly products. You can shop directly or connect with a local representative to host a party, explore special offers, and discover new recipes.

4. Herbalife

Herbalife, another direct sales company specializing in direct selling, has been around for over 40 years, helping people globally earn extra cash and start wellness businesses. They provide the necessary tech and tools to make it simple to begin a side job or personal sales.

Who is the Company for

The company is ideal for those eager to turn their wellness passion into a profitable venture. Whether you’re aiming for additional income or a full-fledged business, its extensive network and resources support your journey.

What Products Company Offer

Herbalife is renowned for its meal replacement and protein supplements, leading the active and lifestyle nutrition market. This health and wellness company product range supports healthy living and provides a solid foundation for building your wellness business.

Here is How to Get Started

For the number of private companies, we have estimated the demand cost for qualified sales or product sales. But this platform has low startup costs and no need for minimum orders; you can begin your journey risk-free. They offer a money-back guarantee, ensuring a reputation for quality with a secure and supported business.

5. Young Living

Young Living’s emphasis is on natural products like essential oils, offering pure, high-quality products. They prioritize natural living, bringing the essence of nature into daily life. Their mission? To provide wellness through the power of nature’s own scents and properties.

Who is the Company For

It caters to anyone seeking a natural approach to wellness and health. Whether you’re into holistic living or just curious about essential oils, they’ve got something for you. It’s ideal for folks keen on integrating nature’s remedies into their routine.

What Products Company Offer

The company boasts many products, from essential oils to blends, diffusers, and wellness items. They’re not just about oils; they offer a full spectrum of natural solutions for personal care, home cleaning, and even pet care.

How to Get Started

Sign up on their website, choose your starter kit, and immerse yourself in the world of essential oils. They provide guides and support to help you make the most of their products and earn up to 40 dollars.

6. Avon

Avon has over 135 years in beauty sales, offering incredible opportunities to earn by selling top-notch products. It’s a space where selling beauty transforms into earning beauty, with no hidden fees and a straightforward commission structure.

Who is the company for

It beckons to anyone aiming to earn through a passion for beauty. Whether you’re looking to sell part-time or full-time, Avon is your platform to shine, offering flexibility to set your schedule and grow your business on your terms.

What Products Company offer

Its catalog includes beauty essentials, from makeup and skincare to wellness products. They also extend into fashion and home, including LG Electronics, ensuring representatives have a diverse range of high-quality items to offer.

How to Get Started

By creating an account to access the best prices and new product launches. Become an Avon, and you can sell virtually or in person, using digital or paper brochures to share and earn on your favorite products.

7. Melaleuca

Melaleuca focuses on creating safe, eco-friendly, and effective products. They believe in a clean home and an environment, offering goods that everyone feels good about using. Their mission is to enhance wellness with nature-inspired solutions.

Who is the Company for

It is for those who value health and the environment. If you’re keen on keeping your living space toxin-free and using products that don’t harm the earth, Melaleuca’s range is tailored for you. It’s perfect for the eco-conscious individual.

What Products Company Offer

This platform offers a variety of products, including supplements, personal care products, beauty items, healthy foods and drinks, and home cleaning essentials. They also provide essential oils and wellness packs designed to support a healthy, eco-friendly lifestyle.

Here is How to Get Started

Getting started with it is simple. Visit their website, browse the product categories that interest you, and select what fits your wellness journey. Their holistic approach ensures you’ll find something that enhances your life and home.

8. Natura

Natura is a brand known for its commitment to sustainability and natural products. They focus on delivering high-quality beauty and personal care items that are kind to both the skin and the environment.

Who is the company for

Natura is perfect for eco-conscious consumers who value natural ingredients and ethical practices. It’s ideal for those who want beauty products that support sustainable living and environmental responsibility.

What Products Company Offers

Natura offers a wide range of products, including skincare, haircare, cosmetics, and perfumes. They emphasize natural ingredients and sustainable sourcing, ensuring everything they make is environmentally friendly and health-conscious.

Here is How to Get Started

Visit their website, browse through their extensive product range, and choose items that align with your beauty and wellness needs. Their user-friendly platform makes shopping simple and satisfying.

9. Nu Skin

Nu Skin Enterprises has been a pioneer in skincare and wellness since 1984. They focus on premium, wholesome ingredients, staying true to their promise of “all of the good, none of the bad.” Their mission? To enhance millions of lives worldwide.

Who is the Company For

Nu Skin is for anyone seeking to improve their skin and overall health with high-quality products. It’s especially ideal for those passionate about anti-aging solutions and natural ingredients, offering a blend of science and nature for optimal wellness.

What Products Does the Company Offer

Nu Skin offers a wide range of products, from skincare to nutritional supplements. Their lines include Nu Skin® for personal care, Pharmanex® for nutrition, and ageLOC® for anti-aging, all developed with cutting-edge scientific expertise.

How to Get Started

Visit their website, explore the product range, and connect with a sales leader. They offer a supportive network and a rewarding compensation structure for those interested in joining their global community.

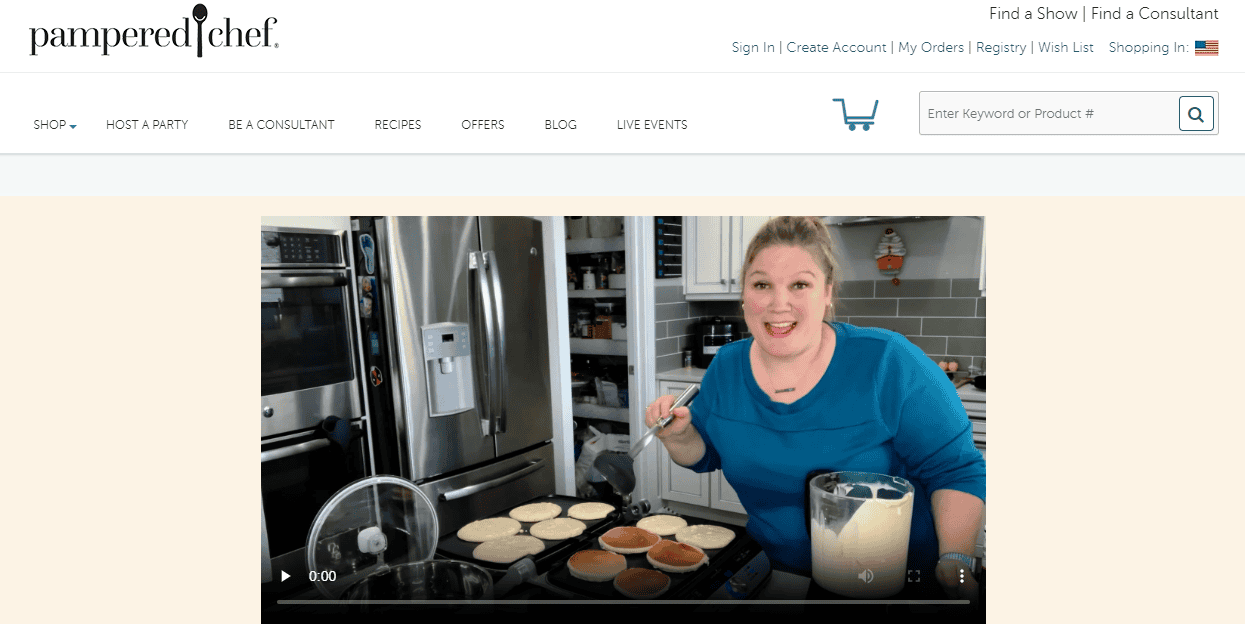

10. Pampered Chef

Pampered Chef offers a unique opportunity to sell kitchen tools and earn commissions. It’s a platform where cooking passion meets entrepreneurship. Starting is easy, with kits for every budget, aiming to make cooking a joyful and convenient experience.

Who is the Company For

It is ideal for those who love cooking and want to earn by sharing their passion. It suits individuals looking to build a business by demonstrating and selling high-quality kitchen products and fostering culinary creativity in others.

What Products Company Offer

This company provides various kitchen tools, from innovative gadgets to durable cookware. Their products, designed to make cooking efficient and enjoyable, include everything from cutting-edge air fryers to classic stoneware, appealing to all cooking enthusiasts.

How to Get Started

Choose a starter kit that fits your budget, from basic to comprehensive sets. With no inventory requirements, you can begin earning through sales and parties, enjoying up to 25% commission.

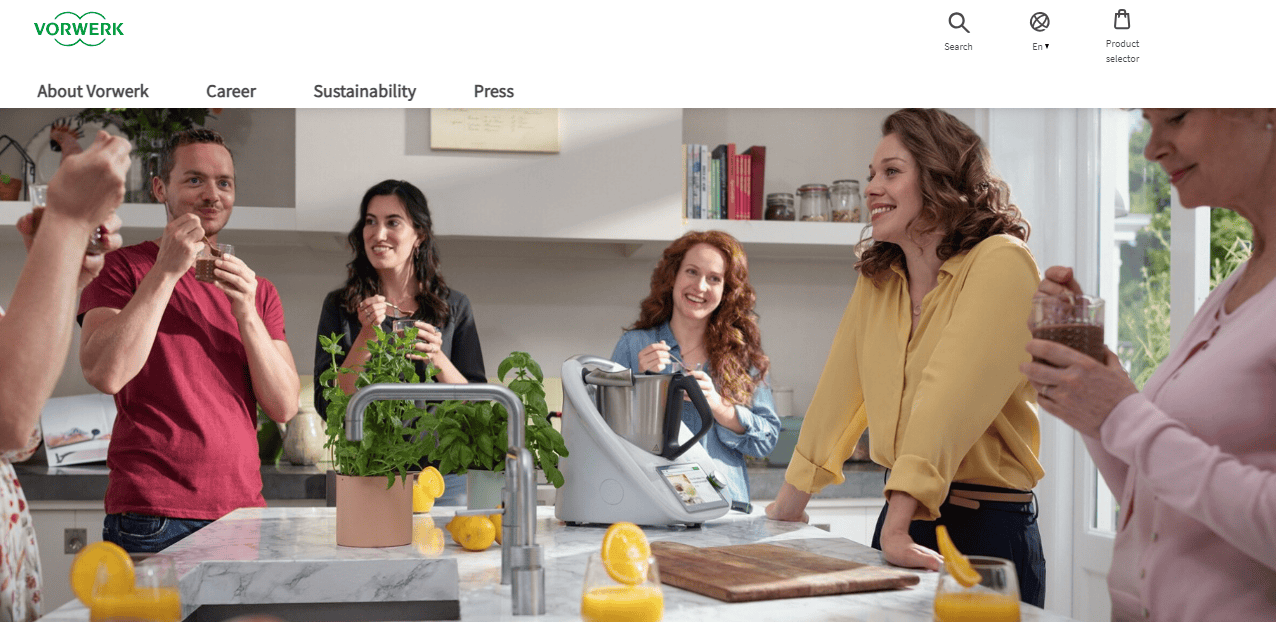

11. Vorwerk

Vorwerk , a well-known German company, specializes in creating high-quality household products. They’re famous for their innovative approach, ensuring every product is designed to make daily tasks easier and more efficient.

Who is the Company For

Vorwerk is perfect for anyone who values quality and innovation in their home appliances. Their products are ideal for busy individuals and families who seek reliable, long-lasting, and user-friendly solutions for their homes.

What Products Company Offer

Vorwerk offers a range of products, including the versatile Thermomix kitchen appliance, Kobold vacuum cleaners, and other home and cleaning devices. Each product is crafted to enhance efficiency and improve the quality of home life.

Here is How to Get Started

Visit their website, explore their product range, and choose the items that suit your needs. You can also contact their customer service for guidance and support in selecting the perfect products for your home.

12. Infinitus

Infinitus brings a fresh perspective to health, emphasizing a life in balance. They blend traditional remedies with modern practices to offer a holistic approach to natural preventive healthcare. Their mission is to help you live a healthier and more meaningful life.

Who is the company for

Infinitus is perfect for those feeling overwhelmed by life’s fast pace and looking for natural ways to improve their well-being. If you’re keen on balancing stress and seeking a holistic health approach, Infinitus has tailored solutions just for you.

What Products Company Offers

Infinitus boasts a range of products focused on enhancing your well-being. They offer health foods for internal balance, skincare for external radiance, personal care for overall wellness, and home care products for a healthier living environment, all rooted in natural and preventive healthcare.

How to Get Started

Getting started with Infinitus is straightforward. Explore their offerings and find what resonates with your health goals. Their holistic health solutions are just a few clicks away, ready to guide you towards a more balanced and fulfilling lifestyle.

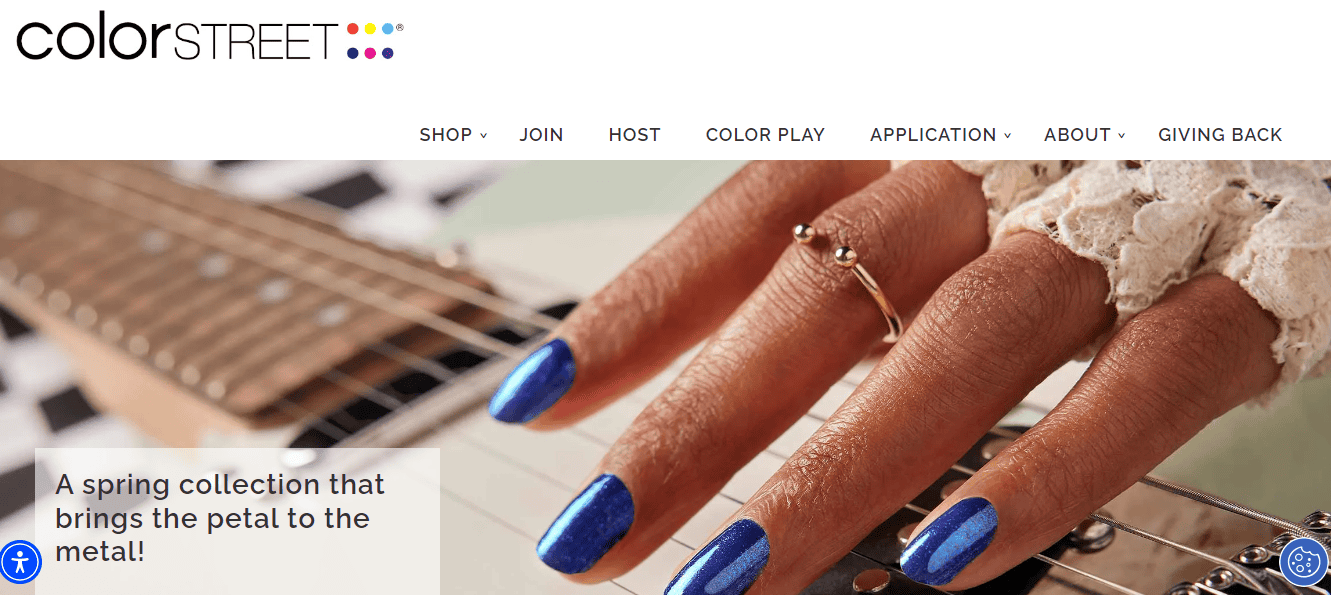

13. Color street

Color Street brings a vibrant twist to nail fashion with its easy-to-apply nail strips. They offer a fun, mess-free manicure experience, perfect for anyone looking to add a splash of color to their style without the hassle.

Who is the Company For

The platform is ideal for busy individuals who crave style and convenience. Color Street’s innovative nail strips are your go-to solution for at-home manicures if you adore having polished, trendy nails but lack the time for salon visits.

What Products Company Offer

The company specializes in a wide array of nail strips that mimic the quality of a professional manicure. Their product line includes a variety of colors and patterns, from bold and bright to subtle and sophisticated, catering to all style preferences.

Here is How to Get Started

Getting started with Color Street is a breeze. Choose your favorite nail strip design, apply it following the simple steps provided, and voilà, you’ve got salon-quality nails in minutes. It’s the perfect way to achieve a stylish look effortlessly.

14. Coway

Coway leads globally in crafting solutions for cleaner water and air. Their every attempt shines through their advanced R&D, ensuring health and a way to earn money from home. This platform promises a healthier indoor environment along with direct selling opportunities.

Who is the Company for

This platform caters to anyone seeking a healthier living space. Their products are ideal for families, health-conscious individuals, and businesses needing pure air and water. Coway’s mission is to improve everyday life, making it a go-to for those prioritizing wellness and giving services directly to consumers.

What Products Company Offers

This platform specializes in innovative water and air purifiers that enhance life quality. The products you sell lineup include state-of-the-art purifiers, bidets, and mattresses designed with cutting-edge technology. These products are tailored to meet diverse needs, ensuring a healthier lifestyle for everyone and a way to earn a significant income.

How to Get Started

Visit their website, explore their product range, and choose what fits your needs. Whether it’s cleaner air or purer water, Coway has the solution. Start your journey towards a healthier living space today and make a sale.

15. PM-International

PM-International stands out as a family-run firm thriving globally. It was founded by Rolf Sorg, who has kept the company’s vision and daily operations closely knit. The company is known for its health, fitness, and beauty products, which empower individuals to achieve better well-being.

Who is the Company For

This platform is ideal for anyone interested in health and wellness. Whether you want to boost your fitness, improve your appearance, or feel stronger and healthier, their innovative product range caters to diverse needs and lifestyles.

What Products Company Offer

The company’s product line, FitLine, offers a line for improved health, fitness, and beauty. They craft innovative items that boost well-being, enhance performance, and support a youthful look, focusing on overall life quality enhancement.

How to Get Started

Visit their website, explore the FitLine range, and choose products that align with your health and beauty goals. Joining their community offers a pathway to a healthier, more fulfilling life.

Wrapping Up

In the vibrant landscape of direct sales, these companies offer diverse opportunities to carve out successful careers. From health and wellness to beauty and home solutions, the direct sales model empowers individuals to achieve financial independence and personal growth.

This detailed analysis of direct sales business helps individuals find an opportunity that aligns with their goals and interests, ensuring a fit that is both rewarding and sustainable. So, find the opportunity and start your own business with the products that you sell, even from home.